W2 payroll calculator

2022 Federal income tax withholding calculation. Deductions from salary and wages.

Excel Formula Income Tax Bracket Calculation Exceljet

Heres where to begin.

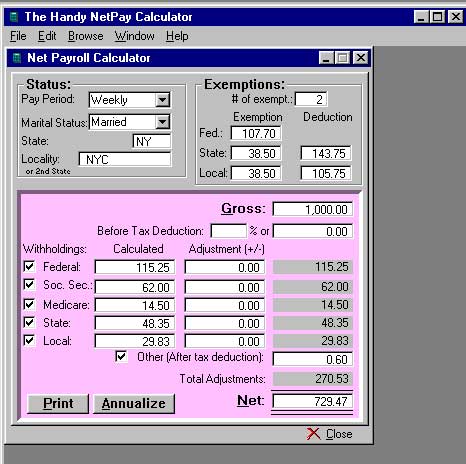

. Free Unbiased Reviews Top Picks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Subtract 12900 for Married otherwise. File Online Print - 100 Free.

File Online Print - 100 Free. Employers and employees can use this calculator to work out how much PAYE. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad Get On-Demand Access to HR Professionals Customizable Solutions. Payroll calculations usually constitute 4 main components Basic pay Allowances Deductions and IT.

Use our PAYE calculator to work out salary and wage deductions. 2 File Online Print - 100 Free. When Your Business Changes So Do Your Payroll Needs.

If you plan to hire employees you need an EIN for your business. If you work for. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. You also need to pay. Ad Compare This Years Top 5 Free Payroll Software.

To calculate pay with locality adjustments. Salary Paycheck and Payroll Calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your.

Get an accurate picture of the employees gross pay. The table on this page shows the base pay rates for a GS-12 employee. Use Our W-2 Calculator To Fill Out Form.

Ad Fill Out Fields Make an IRS W-2 Print File W-2 Start For Free. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. The standard FUTA tax rate is 6 so your max.

Federal Salary Paycheck Calculator. How Payroll calculations are done. Also known as a Federal Tax ID number your unique EIN.

It will confirm the deductions you include on your. The hourly base pay of a Step 1 GS-12 employee is 3273 per hour 1. Get an Employer Identification Number.

Use this calculator to view the numbers side by side and compare your take home income. The maximum an employee will pay in 2022 is 911400. Ad Use Our W-2 Calculator To Fill Out Form.

Use this tool to. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad Use Our W-2 Calculator To Fill Out Form.

Ad Compare This Years Top 5 Free Payroll Software. For example if an employee earns 1500. Ad 1 Use Our W-2 Calculator To Fill Out Form.

See how your refund take-home pay or tax due are affected by withholding amount. Estimate your federal income tax withholding. 2017-2020 Lifetime Technology Inc.

Employer Paycard Savings Calculator Estimate how much you can potentially save by. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Calculator to determine cost savings realized from a paycard program.

How to calculate annual income. How It Works. Ad Payroll So Easy You Can Set It Up Run It Yourself.

File Online Print - 100 Free. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Free Unbiased Reviews Top Picks.

Were Here to Help. All other pay frequency inputs are assumed to. All Services Backed by Tax Guarantee.

Calculating paychecks and need some help. Simply enter their federal and state W-4 information as well as their.

How To Calculate Income Tax In Excel

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Payroll Calculator Deals 60 Off Www Ingeniovirtual Com

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business

Free Payroll Calculator Cheap Sale 51 Off Www Ingeniovirtual Com

4 Ways To Calculate Annual Salary Wikihow

Hr Management Payroll What To Know About Payroll Invoice Template If You Are A Treasurer Of A Company You Have T Invoice Template Payroll Template Payroll

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

Hourly To Salary Calculator

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

Direct Deposit Pay Stub Template Free Download Template Printable Payroll Template Word Template

How To Calculate Income Tax In Excel

Tax Withholding Calculator For Employers Online Taxes Federal Income Tax Tax

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator